Electric vehicles (EVs) have moved from niche to mainstream in less than a decade. Central tothat transition is lithium – the light metal that makes modern rechargeable batteries possible. Asgovernments, automakers, and investors race to electrify transport, lithium has become one ofthe most strategically important natural resources of the 21st century. This blog explains how lithium powers the EV revolution, why nations and companies are competing fiercely forreserves, the environmental and social trade-offs of extraction, and what the long-term picturelooks like.

Lithium’s appeal comes from its chemical properties: low atomic weight and highelectrochemical potential deliver batteries with high energy density and relatively low mass.Modern lithium-ion chemistries (NMC, NCA, LFP and their variants) are the backbone of EVdrivetrains and grid-scale storage. Improvements in cell design, manufacturing scale andchemistry have driven battery cost declines and range improvements – and those gains translatedirectly into more affordable, longer-range EVs. The International Energy Agency notes thatlithium-ion battery pack prices dropped meaningfully in recent years, helping drive EV adoption.

Put simply: more EVs = more batteries = more lithium.

EV sales and energy storage deployments are the single biggest drivers of lithium demand.Global EV sales surged from a few million units in 2020 to many millions yearly; evenconservative scenarios foresee multi-fold increases in battery capacity required by 2030. Thatrising battery capacity translates to rapidly growing demand for lithium carbonate and lithiumhydroxide (the two common commercial forms). Forecasts vary by adoption speed, batterychemistry mix, and recycling rates, but the overall trajectory is upward – supply constraints,policy interventions and new extraction projects will determine pricing volatility. Industryobservers report swings in spot prices and revisions to 2030 demand estimates as OEM plansand policy incentives evolve.

2. Building a Circular and Value-Added Economy

There are three dominant sources of extractable lithium:

Production today is concentrated: Australia and Chile have been dominant producers, with China a major processor and battery manufacturer. Reserves and resources are more widely distributed: Bolivia, Argentina, Chile and Australia hold the largest known resources, though extraction readiness differs greatly between jurisdictions.

Lithium is not just an economic commodity; it’s a geopolitical asset. A few factors make it strategically sensitive:

These dynamics have given rise to what many call a “lithium gold rush”: bids, joint ventures, and national plans to accelerate exploration and bring reserves into production.

Lithium extraction brings environmental and social costs that vary by extraction method and local context.

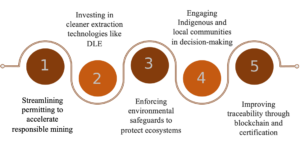

A responsible lithium strategy requires stricter environmental standards, meaningful local engagement, and independent monitoring – alongside investments in lower-impact extraction and remediation technologies.

Lithium markets have been volatile. Rapid demand growth can tighten markets and push spot prices high – which incentivizes rapid investment and speculative supply – and then oversupply or slower EV rollouts can depress prices. Industry leaders have occasionally revised demand outlooks and we’ve seen wide price swings in recent years. That volatility affects miners’ willingness to finance long-lived projects and prompts manufacturers to secure long-term contracts or backward-integrate.

Recycling battery materials – and designing batteries for disassembly – is a key route to loweringdependence on primary lithium extraction over time. The recycling industry is scaling rapidly(multi-billion USD market today with high projected growth), driven by regulations, OEMcommitments and the economics of recovered critical metals. Technologies includepyrometallurgical, hydrometallurgical and emerging direct-recycling processes that aim torecover cathode materials with lower energy and cost. While recycled lithium won’t eliminateprimary needs in the near term, improved collection, standardized battery formats and moreefficient chemistries will make recycling an essential part of long-term supply security.

Lithium sits at the center of the energy transition: enabling EVs and grid storage, but raisingcomplex environmental, economic, and geopolitical questions. The coming decade will likely bedefined by parallel tracks: rapidly growing battery deployment, intensified competition tosecure supply chains, and parallel investments in less-impact extraction and robust recycling.How governments, companies and communities navigate these choices will determine whetherthe “lithium gold rush” becomes a sustainable enabler of decarbonization or a source of newconflicts and environmental harm.

FAQs

Q – Will lithium run out?

A – No immediate physical shortage: resource estimates are large. The challenge is turning identified resources into economically and socially acceptable production at the speed required.

Q – Can recycling replace mining?

A – Not in the near term. Recycling will become increasingly important, but primary lithium will still be needed for decades while recycling scale and collection catch up.

Q – Is all lithium extraction equally damaging?

A – No. Environmental impacts vary widely by method, location, and regulation. Brine operations, hard-rock mines and clay deposits each have distinct footprints and risks. DLE mayreduce some impacts but is not yet a panacea.